As a freelancer or a small business owner, you must keep records of all the invoices you send to your clients. It’s your professional duty to send invoices to keep the cash flow consistent. Especially when you’re a contract-based service provider, you might face situations when some of your clients might miss the due date for payment. In that case, you need to send an overdue payment letter to them as a reminder.

It’s always uncomfortable to chase your clients. At some point, your client might have been in a troublesome period of life. You may not know his part of the story. Therefore, it’s not wise to ambush your client and ask for payment directly. You can’t ask your clients for the due payments, whether over verbal communication or an overdue account letter.

Table of Contents

You must show good manners to maintain the customer relationship regarding overdue payment issues. In that particular case, a well-written friendly overdue payment letter can get your job done as fast as possible.

In this article, you will learn a lot about overdue payment letters.

So, let’s demonstrate this further.

Understanding an Overdue Payment Letter

An overdue payment letter is a written communication sent by a creditor to a debtor when a payment has not been made within the agreed-upon timeframe. This type of letter serves as a gentle reminder to the debtor that their payment is overdue and requests immediate action to rectify the situation. Understanding an overdue payment letter is crucial for both debtors and creditors as it helps maintain clear lines of communication and facilitates the resolution of outstanding payments.

When receiving an overdue payment letter, debtors should carefully read the contents of the letter to understand the nature of the outstanding payment. The letter typically includes details such as the original amount owed, the due date, any applicable interest or late fees, and a new deadline for payment. Debtors should pay close attention to these details to ensure they have an accurate understanding of the situation.

It is essential for debtors to respond promptly to an overdue payment letter. Ignoring or neglecting the letter can lead to further consequences such as damaged credit scores, legal action, or strained relationships with the creditor. Instead, debtors should reach out to the creditor as soon as possible to discuss the situation and negotiate a solution. This may involve explaining any extenuating circumstances that caused the delay or proposing a revised payment plan that is mutually agreeable to both parties.

Now let’s see how to bring the best out of an overdue payment letter:

Send Reminders on Time: It’s always a great idea to send the invoices promptly. It increases the chance of settling overdue payments. So, you must send the invoice(s) closer to the due date. It reminds your client(s) of scheduled payments. Be consistent and punctual in this regard. You can also communicate with your client via Phone if that’s possible.

Be more precise and insightful when sending overdue payment letters. Send all the payment details and company policies rather than asking for direct payment. It’s a way of being transparent in the eye of the client. Your client will know the details and take the matter more seriously. Suddenly asking for the payment might hinder the relationship between you and your clients.

Change Your Tone Depending on the Situation: You must be clear, firm, and professional in sending overdue payment letters. Keep your tone calm and polite when sending the invoice before or after the due date. If the due date is past a few weeks, you must keep the style professional and straightforward but modest.

If nothing works, do not push yourself further. Take help from a legal team or a collection agency. They’ll take care of the rest. Being an entrepreneur was never a piece of cake. As a freelancer or a business owner, you must take challenges and face them wisely. Remember that your customers are the change makers. So, be polite to your customers.

Have patience when collecting overdue payments. Showing your anger and saying harsh words may not solve your problem; instead, it can worsen it. So, be as gentle as possible whenever contacting your clients.

Offer an Installment Plan: You can be empathetic and gentle if your client struggles to pay the due. You can offer an instalment plan if that’s possible, of course. Your client might find this way more comfortable than paying in full. However, an instalment offer is the last resort before you go for any legal action. Do not just make an instalment offer to all of your clients.

Keep the Letter Simple and Short: Writing an overdue payment letter is easy. Do not fill the letter with unnecessary sentences. Keep it short and precise. Your customer may feel uncomfortable seeing a letter with hundreds of words.

Now, let’s see how to write tailored overdue payment letters from scratch. It’s not as complicated as you think. After reading the entire article, you will be prepared to write an overdue account letter.

How to Write a Friendly Overdue Payment Letter?

Firstly, you need to know the types of overdue account letters. All your overdue payment reminder letter words must be more precise about the overdue invoice letters based on the ongoing situation. There’re three common types of overdue letters, as follows:

- Reminder Letter

- Follow-up or Final notice, and

- Legal action.

Overdue Payment Letter for Reminder

You can send a reminder of the overdue payment invoices before the due date is nearby. If you’re planning to send the invoice before the due date, make sure it’s a week before, at least. So, how to write an overdue invoice letter profoundly? Let’s find out.

It’s the most straightforward, modest, and friendly approach to writing a short overdue letter before the due date.

If your client is a forgetful person, this simple notice will remind them of the due payment, and they will likely pay you as soon as possible.

Follow-Up or Final Notice

You’ve sent the first reminder letter to your client, but there’s no response yet. However, It’s been a few weeks since the due date has passed. Now, what to do? In such circumstances, you must send your client another follow-up letter. So, how to write a perfect follow-up or a warning letter for outstanding payment? Remember, you still need to be polite while writing a follow-up final notice. Let’s see an example of a follow-up letter.

That’s all it takes to write a follow-up or a final notice letter. Not so complicated at all, right?

A follow-up overdue letter helps you get traction from your clients in case they haven’t checked the first letter or have forgotten about that. A solely responsible customer should get back to you soon.

Overdue Payment Legal Action

You’ve done everything but still no response from your clients. A few questions might be circling your head. Should you wait for more? Should you send another warning letter for the outstanding payment?

The answer is no. Even if you wait or send another overdue letter, the chances of your client replying are less. It’s time for an overdue payment letter legal action. Sending a legal notice to your client might cut the hassles short.

It’s time to take legal action. It might sound harsh, but there’s no other way. You’ve done everything possible to communicate with your clients, but nothing worked. So, going to and talking to a lawyer or a collection agency will likely solve your problem. Sometimes we have obstacles in life, but we need to handle those wisely. Life is all about moving forward without giving up.

There’s one more piece of advice for you. You can automate your invoicing system. Want to know how? Let’s go!

Propovoice – The Automated Invoicing Solution

Overdue invoices management is a challenging job to maintain. As a business owner or a freelancer, you must keep your eyes on all sorts of documents. Propovoice CRM and the invoicing plugin can make your work easier and more flexible.

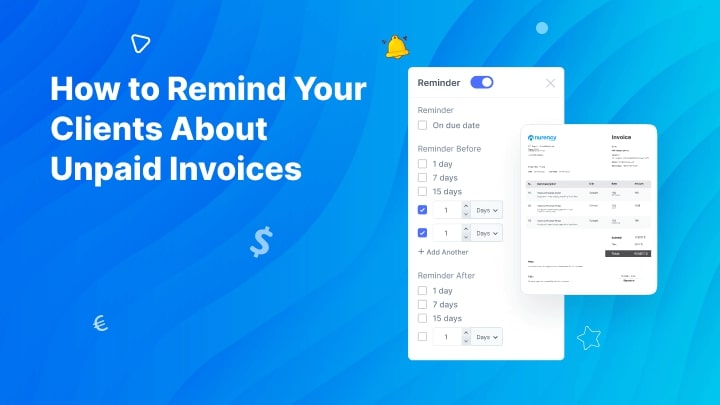

Propovoice can send overdue invoice reminder emails automatically according to the scheduled date. It has many pre-built templates that allow you to create any invoice within a few clicks. Propovoice offers numerous features that keep your client management and invoicing workflow on the same track.

How do I write an overdue payment letter?

Section 1: Understand the Importance of an Overdue Payment Letter

Before diving into the writing process, it’s crucial to understand why an overdue letter is necessary. This letter serves as a formal reminder to the debtor, notifying them about the outstanding payment and the consequences of further delay. It also helps in maintaining clear communication and demonstrating your professionalism as a creditor.

Section 2: Gather the Necessary Information

Start by gathering all relevant information related to the overdue payment letter. This includes the debtor’s name, contact details, invoice number, due date, and the amount owed. Having this information at hand will ensure accuracy and help in personalizing the letter.

Section 3: Format the Letter Properly

A well-structured and formatted letter increases its impact and readability. Begin with your name, company name, address, and contact information, followed by the recipient’s details. Use a formal salutation such as “Dear [Debtor’s Name],” to maintain a professional tone throughout the letter.

Section 4: Begin with a Polite Opening

In the opening paragraph of the overdue payment letter, express your appreciation for the business relationship and briefly mention the purpose of the letter. Be polite and avoid using confrontational language, as the goal is to remind the debtor rather than create conflict.

Section 5: Provide Details and Specify the Amount Due

In the subsequent paragraphs, provide specific details about the overdue payment. Include the invoice number, date of issuance, due date, and the exact amount owed. This information will help the debtor identify the outstanding payment easily and minimize any confusion.

Section 6: Highlight Consequences and Set a Deadline

Clearly communicate the consequences of continued non-payment. This may include late payment fees, suspension of services, or potential legal action. Emphasize the importance of settling the debt promptly and setting a firm deadline for payment.

Section 7: Offer Assistance and Alternative Payment Options

To facilitate a resolution, offer assistance to the debtor if they are facing difficulties in making the payment. This can include flexible payment plans or alternative payment methods. Showing empathy and willingness to work together can encourage a positive response.

Section 8: Closing Remarks

In the closing paragraph, restate your expectations and reiterate the importance of resolving the matter swiftly. Thank the debtor for their attention and express your hope for a prompt resolution.

Section 9: Proofread and Sign the Letter

Before finalizing the letter, carefully proofread it for any grammatical or spelling errors. Ensure the letter maintains a professional and respectful tone. Finally, sign the letter with your name and title to add a personal touch.

Section 10: Sample Overdue Payment Reminder Template

If you’re still worried about writing an overdue letter, you can use any of the templates provided by the Propovoice CRM plugin. There are a number of free templates you can use.

How do you politely ask for overdue payment?

Asking for overdue payment can be a delicate situation, but it’s an essential part of managing a business or maintaining financial stability. When it comes to addressing overdue payments, it’s important to strike a balance between being firm and maintaining a polite and professional demeanor. Here are a few tips on how to politely ask for overdue payment:

Choose the right communication method: Consider the nature of your relationship with the client or customer and the urgency of the situation. Sending a gentle reminder via email or making a phone call can be a good starting point. Choose a method that is convenient for both parties and allows for clear communication.

Use a polite and professional tone: When reaching out, maintain a polite and respectful tone throughout your message. Start by expressing your appreciation for their business and remind them of the outstanding payment in a non-confrontational manner. Avoid using accusatory language or sounding frustrated, as it may strain your relationship with the client.

Provide clear details and reminders: In your communication, be specific about the payment details, such as the amount owed, the due date, and the invoice number. This helps the client identify the specific payment you are referring to and reduces any potential confusion. Additionally, if there are any late fees or consequences associated with late payments, mention them tactfully but firmly.

Offer assistance or alternative solutions: Sometimes, clients may be facing financial difficulties that hinder their ability to pay on time. In such cases, it can be helpful to offer assistance or alternative solutions. You could suggest setting up a payment plan, extending the deadline, or accepting partial payment, depending on your business’s policies and the client’s circumstances. Showing flexibility can foster goodwill and increase the chances of receiving payment.

Follow up politely: If you don’t receive a response or payment after your initial communication, it’s important to follow up politely. Send a gentle reminder after a reasonable period, reiterating the importance of settling the outstanding payment. However, be cautious not to become too persistent or pushy, as it may harm the relationship.

Remember, the goal is to maintain professionalism and resolve the overdue payment issue amicably. By employing a polite and considerate approach, you increase the likelihood of receiving the payment while preserving your business relationships.

How do you politely say invoice is overdue?

It can be uncomfortable to have to remind a client or customer that their invoice is overdue. However, it is important to communicate clearly and professionally to ensure timely payment. The best way to approach this situation is to use polite and respectful language that emphasizes the importance of the payment and the impact it has on your business.

One option is to send a gentle reminder email or letter that acknowledges the relationship between you and the client. You can start by expressing gratitude for their business and then mention that the invoice is overdue. Instead of making accusations or using a confrontational tone, use language that conveys concern and a desire to resolve the issue together. For example, you could say “I hope this message finds you well. I wanted to touch base with you regarding invoice #______, which appears to be past due. We value our relationship with you and hope to resolve this matter as soon as possible.”

It’s important to also provide clear and specific instructions for how the client can make the payment. This could include providing a link to an online payment portal or offering to accept payment over the phone. Additionally, you can set a clear deadline for the payment and mention any late fees or consequences that may result from continued non-payment. By communicating in a respectful and professional manner, you can encourage your clients to prioritize timely payment and maintain a positive working relationship.

Final Words

Finally, the importance of an overdue payment letter is now clear to you. You can write your due invoice letter without breaking a sweat. This article is solely research-based. Many freelancers and business owners deal with overdue payment problems. This article will help those individuals who don’t know how to cope with the due payment clearance.

Was this article helpful enough? Did you face a due payment issue with any of your clients? You can share your experience and piece of suggestions with us.

That’s a wrap for the day. Cheers.